Like every year, the annual Report published by the Italy China Council Foundation – one of the most comprehensive annual publications on China to be found in Italy – arrives punctually. This year it has reached its 14th edition and is presented in a totally new layout and divided into two parts for the first time (the second will arrive in September with data from the second quarter in order to be as up-to-date as possible).

Presented on 4 May at the headquarters of Confcommercio in Milan, the first part of the Annual Report ‘China 2023, we (re)start from consumption’ offers a useful scenario for Italian SMEs that already do business with China or want to start doing so, analysing the criticalities for the restart of private consumption, the evolution of the Chinese consumer in recent years, but also the new geography of consumption in China and the main consumption trends. Consumption, which has been the driving force behind China’s economic recovery in the first quarter of 2023 but which is nevertheless growing unevenly.

China: an excellent partner for non-European trade

China is now the 10th largest destination market for Italian exports, the 4th largest outside Europe, the 1st largest in Asia, and Italy’s 2nd largest supplier after Germany, while Italy is China’s 24th largest supplier and its 22nd largest market.

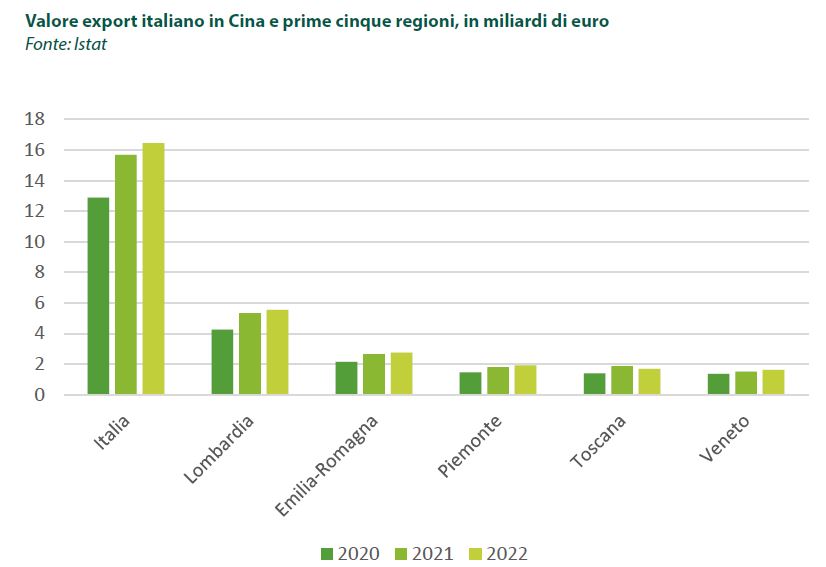

According to Istat, the total value of interchange in 2022 reached €73.9 billion (+36.3% y/y), of which €57.5 billion (+49% y/y) of imports from China to Italy and €16.4 billion (+0.5% y/y) of Italian exports to China. Specifically, at regional level, Northern Italy has the highest number of regions with important trade values: Lombardy (33.8% export; 39.8% import), Emilia-Romagna (16.7% export; 10.25% import), Piedmont (11.8% export; 7% import), Tuscany and Veneto.

Talking about the sectors to be taken into consideration for investments in China, the Annual Report highlights how, over the last year, the sectors with the most interesting values of growth in Italian exports are those in line with developments in the Chinese market, in particular the pharmaceutical sector (+50% y/y, equal to €1.5 billion) and the chemical sector (+20.8% y/y, equal to a record value of €1.43 billion). Textiles and clothing (+12.4% y/y, or €3.5 billion), machinery, automotive and food & beverage are also worth mentioning.

The Annual Report also contains a number of recommendations for Italian companies:

- the first, and essential, is to make greater investment in digital, a must now not only for companies with consumer products and services, but also for the B2B world

- along these lines, it is also important to align one’s products with the new demands of Chinese consumers, who are increasingly inclined to reward companies capable of producing a positive social impact

- another indication is to establish strategic collaborations with local partners as this can facilitate the activities of Italian companies, enabling them to establish better relations with consumers and exploit already existing commercial channels

- finally, it is necessary to envisage new strategies to remain competitive in the Chinese market, including, for example, secondary and localised cities in China, in order to serve the domestic market more efficiently.

New opportunities to be seized

Although the country of the Dragon represents an international level competitor in several sectors, it is essential to highlight some opportunities, such as the fact that it is a market with great prospects for growing domestic demand, fueled by an increasing per capita income, and by the preference of a growing segment of affluent consumers for the excellence of Made in Italy, and that it is an increasingly important player in high-tech sectors thanks to the resources invested in the ecosystem of research, innovation and digital.

Despite the positive picture presented for Italian companies, Italy is currently in a developing diplomatic situation with China: by the end of the year, our government will in fact have to decide whether to withdraw from the One Belt One Road (BRI) agreement signed in 2019 (Italy is the only G7 nation to have officially joined).

The signed memorandum of understanding provides for automatic renewal for another five years, unless Italy informs Beijing of its intention to withdraw by next December. The Euro-Atlantic allies are hoping for Italy’s exit from the agreement, but the executive at the same time does not want to jeopardize relations with China for fear of retaliation and consequences, especially on the trade front, and for this reason has informally asked to extend the decision by a few months.

Given the situation, and considering China’s growing influence not only in the East but also in Africa for many years now and for some time now in the Balkans, the decision on the One Belt One Road could change the dynamics of Italy’s trade exchanges in the coming years, it will therefore be necessary to work to better interact with China by strengthening dialogue to ensure further development of trade cooperation.

At Roncucci&Partners we help companies to develop themselves and their business, to embrace change and evolve in order to thrive in a world that is increasingly complicated, insidious and requires a great deal of expertise. We do this by applying timely methods and rigorous strategies, the fruit of many years of experience and the wealth that comes from the many successful cases we have led around the world. Passion and method are indeed our guides to enhance the present and build the future.